quicken tax planner problem

You contact your employers 401k provider and request a rollover Lowell said. My spouse and I have two kids not yet teens and a decent 7 digit portfolio in the taxable brokerage accounts and retirement accounts 403b roth IRA and own one primary house and a rental house and live in California.

My Roth Conversions Are Not Showing Up In Tax Schedule Report Quicken

It provides a framework for newlyweds and parents for those planning travel or deployment.

. EAs could help you work through an IRS audit or a collection problem and they can also perform bookkeeping services that could be useful for businesses when preparing tax returns. Rolling a Roth 401k into a Roth IRA isnt that different from completing a normal rollover from a 401k to an IRA says Dave Lowell a certified financial planner CFP based in the Salt Lake City area. Rules to claim your senior property tax exemption and the amount your taxes could be reduced varies by state.

Youve got some cash in a savings account earning a paltry 001. If youre not satisfied return this product to Quicken within 30 days of purchase with your dated receipt for a full refund of the purchase price less shipping and handling fees. You plan to spend it to buy a home or a car or something else in a few years.

Quicken Home Business offers a Schedule C report and Tax Schedule report. Read this Personal Capital review to learn more about this money. CPAs however are more adept in meeting your financial planning and accounting needs.

Its a common problem. Thats in addition to federal income tax. The planner also checks to see if your investments are properly diversified and if your current ETF and mutual fund fees are higher than the category average.

Your assets and liabilities. The problem with this is that interest on credit card loans is usually much higher than what you would get for a home loan. Just wanted to see if anyone had any experience with or thoughts about the DIY software from Quicken and Nolo to make a living revokable trust.

What accounting software and systems have you utilized and which. Updated the W4 tax rates and mileage rates in the Tax Planner. From there Id test for more advanced errors like transposed numbers Q.

Problem-solving skills and analytical abilities. In this way you are able to gain immediate access to the proceeds from the sale of 20000 in employer stock from your 401k plan for just 600. The retirement planner calculator tells you best and worst case retirement scenarios.

Your estate planning and final wishes. You will then have to calculate your income tax liability based on your net profit. It shows how much monthly spending your current portfolio will allow throughout retirement.

An issue where the new status blue icon of a transaction was not cleared after the transaction was edited. Get It Together is a guide and resource to help you create your own personal planneran organizer for you and an eventual road map for your loved ones. Once I confirmed the error Id look for an entry the same amount.

Online services like Legal Zoom US Legal Wills and Nolos Quicken WillMaker Trust pointedly advertise the low cost of their services and offer basic packages for a. A perfectionist and detail-oriented mind. They are not likely to accept a credit card loan as a down payment because the point of a down payment is for them to see that you are a worthy risk.

An issue where a change to a transactions status made on Quicken on the Web could sometimes fail to sync back to Quicken desktop. That works out to be just 3. Online tests and quizzes.

We offer essay help for more than 80 subject areas. This powerful software guides you through the process from beginning to end giving you the practical and legal information you need to make the best decisions for you and your family. Quicken WillMaker Living Trust 2021 Premium is the easiest way to create your estate plan whether youre just getting started or you want to update your previous arrangements.

This is my go to resource to check on and analyze my investment performance and income versus spending. Articles and article critique. Theres also a tax center where you can view your estimated taxes stay on top of important tax dates and view your taxable income and tax-related expenses.

It covers 28 topics including you your family your work endeavors. Apart from that usually lenders want to know where the money for the down payment came from. Quicken for Mac imports data from Quicken for Windows 2010 or newer Quicken for Mac 2015 or newer Quicken for Mac 2007 Quicken Essentials for Mac Banktivity.

30-day money back guarantee. And when it comes to tax planning they can also help you identify tax credits and deductions. Estimate and plan.

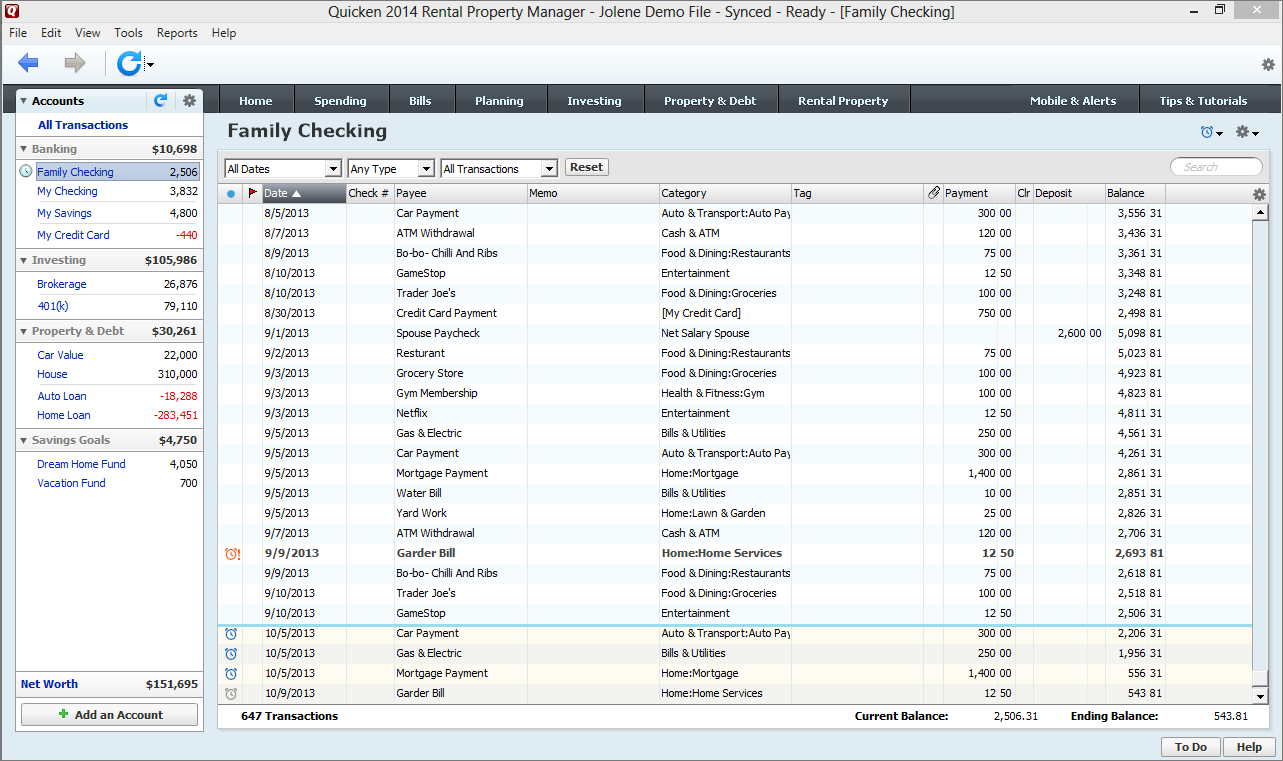

Personal Capital also allows you to stay on track when it comes to managing your budget paying your bills and meeting your financial goals making it the best personal budget software to. I dug into the budgeting tool with Quicken. The Cash Flow Analyzer tool also has advanced capabilities that allow you to zero in on problem budgeting areas and find places to save.

Quickens robust financial planning tool includes several options such as budgeting tax planning and long-term planning. Its easy to use and automatically updates unlike Quicken where I. You can get help on any level of study from high school certificate diploma degree masters and PhD.

So check with your local tax authority or financial planner for more information. A systematic methodical and process-based approach to projects. Theres also a tax planner that helps you estimate your annual taxes.

How to Roll Over a Roth 401k to a Roth IRA. You can create and save as. This tool lets you see if youre currently on track to meet your retirement goals.

If you have an immediate need for the funds this would be a highly tax-efficient way. Youll also have to pay self-employment tax which is the self-employed equivalent of the FICA tax. What subjects do you write on.

But since youre in the 0 bracket for long-term capital gains theres no tax liability due on the sale of the stock. Another neat feature is its retirement planner tools. Its equal to 153 of your net profit.

Estimated taxes are due on four dates each year.

Quicken Support Phone Number 1877 980 4312 24 7 By Quicktech Solution Quicken Phone Support Accounting Software

401k Scheduled Deductions In Tax Planner Quicken

Tax Planner Other Withholding Using Wrong Total Quicken

How I Learned To Love Quicken Deluxe And Give Up On The Past Tidbits

888 846 6939 Instant Quicken Help To Fix Quicken 2018 Issues

Tax Planner And Import Data From Turbotax Quicken

Tax Planner Other Withholding Using Wrong Total Quicken

Quicken Phone Support Number By Experts Certified Accounting Experts Are Here To Help You Dial 1866 209 3656 Accounting Software Quicken Financial Information