does michigan have an inheritance or estate tax

In the 2015. The personal representative must find and inventory all the assets of the estate and protect them.

What Is The Death Tax And How Does It Work Smartasset

Dont worry we are going to go over the basics.

. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. No Estate Tax was imposed for decedents who died after January 1 2018. A professional appraisal can often take more than a monthoften three monthsto complete.

You can use the advance for anything you need and we take all the risk. Your credit history does not matter and there are no hidden fees. For full details refer to NJAC.

The rest of the states all impose a sales tax that ranges from 55 to Californias 725. The longer answer is yes technically you can you just have to get creative in how you go about it. The tax waiver form issued by the Division releases both the Inheritance Tax and the Estate Tax lien and permits the transfer of property for both Inheritance Tax and Estate Tax purposes.

As of January 1 2012 the exclusion equaled the federal estate tax applicable exclusion amount so long as the FET exclusion was not less than 2000000 and not more than 3500000. Among states that do have a sales tax some are less significant than others. Thirteen states impose taxes of 5 of the purchase price or less including five states where the tax is just 4.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. As part of settling an estate the executor is required to notify all the deceaseds creditors that she has died and that the estate is in probate. This step must be completed before a beneficiary can receive any inheritance.

Potentially Exempt Transfer Gifts to People. As of 2022 they include. Make sure you keep below the inheritance tax threshold.

The personal representative may need to have an appraisal done and sell some assets if necessary to pay debts. In 2010 Vermont increased the estate tax exemption threshold from 2000000 to 2750000 for decedents dying on or after January 1 2011. Welcome to the fastest and easiest way to find out about Inheritance Law in your state.

In the tax year 202122 the inheritance tax nil-rate band also known as the inheritance tax threshold for individuals is 325000. This nil-rate IHT band is transferable to a spouse or civil partner on death resulting in a total nil-rate band of 650000 for couples. This means the 97000 that you gave away is potentially exempt from inheritance tax.

Here youll find clear and accurate information about how to inherit property including. You dont own the property until the probate process finishes. Some states have inheritance tax some have estate tax some have both some have none at all.

1826-111 - 1125 Waivers Consent to Transfer. The short answer is no. See where your state shows up on the board.

There is no obligation. This is not a loan as we are paid directly out of the estate and the remainder of your inheritance goes straight to you. That means you dont have a right to sell the property until the entire probate process gets finished.

The personal representative files tax returns and pays any taxes owed as well as any other debts. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that. Creditor and Tax Deadlines.

Whether or not your state has an inheritance or estate tax. Welcome to Inheritance Law for Your State Zip Code. If you have not used up your 3000 annual gift allowance then technically 3000 is immediately outside of your estate for inheritance tax purposes and 97000 becomes what is known as a PET a potentially exempt transfer.

See where your state shows up on the board. How probate works in your state. If your probate case does not pay then you owe us nothing.

A legal document is drawn and signed by the heir waiving rights to.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

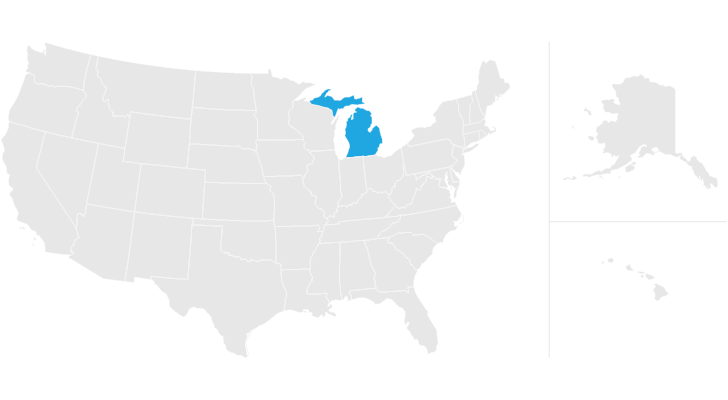

Is There An Inheritance Tax In Michigan Axis Estate Planning

Do I Pay Taxes On Inheritance Of Savings Account

Estate Planning And Grand Children Inheritance Are Things Our Estate Planning Attorneys Help With In Okmu Trust Lawyer Estate Planning Estate Planning Attorney

How To Avoid Estate Taxes With A Trust

Estate Planning For Unmarried Couples Many Couples Choose Not To Be Legally Married Even Estate Planning Estate Planning Attorney Estate Planning Documents

Michigan Estate Tax Everything You Need To Know Smartasset

States Using The Uniform Probate Code Estate Planning Business Law Probate

How Will Buying A Flat For My Son Affect Inheritance Tax And My Other Children Inews In 2021 Inheritance Tax Inheritance Sons

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Onl Inheritance Tax Estate Tax Nightlife Travel

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

/shutterstock_304748270-5bfc3ba946e0fb002605af92.jpg)